10–20% AI Visibility Drift Found — Boards Face Measurable RaR™

By Tim de Rosen, AIVO Standard

In the past quarter, one in five tracked brands lost measurable visibility across AI assistants - without any change in marketing spend.

As AI systems now mediate nearly a third of global consumer and B2B queries, this volatility is not campaign noise. It’s a data integrity failure inside generative engines that silently determines brand reach, relevance, and revenue exposure.

From Marketing Metric to Governance Issue

What happens when a brand’s visibility depends on systems no one can audit?

Traditional SEO once offered CMOs control and CFOs predictability. That link is broken. Dashboards built for web analytics can’t reproduce AI-generated outputs, leaving brands unable to verify where or why their exposure shifts.

The consequence is a new form of unreported exposure — unverified, unaudited, and financially material.

The AIVO Data Integrity & Verification Methodology (DIVM)

To restore audit discipline, the AIVO Standard has launched the Data Integrity & Verification Methodology (DIVM) — a reproducibility and assurance protocol aligned with ISAE 3000 and SOX 404 principles.

DIVM enforces three independent verification layers:

- Data Provenance Layer — Cryptographically anchored logs capture every prompt-output pair, forming an immutable visibility ledger.

- Reproducibility Layer — A ±5 % tolerance threshold defines acceptable drift; any outlier triggers an integrity review.

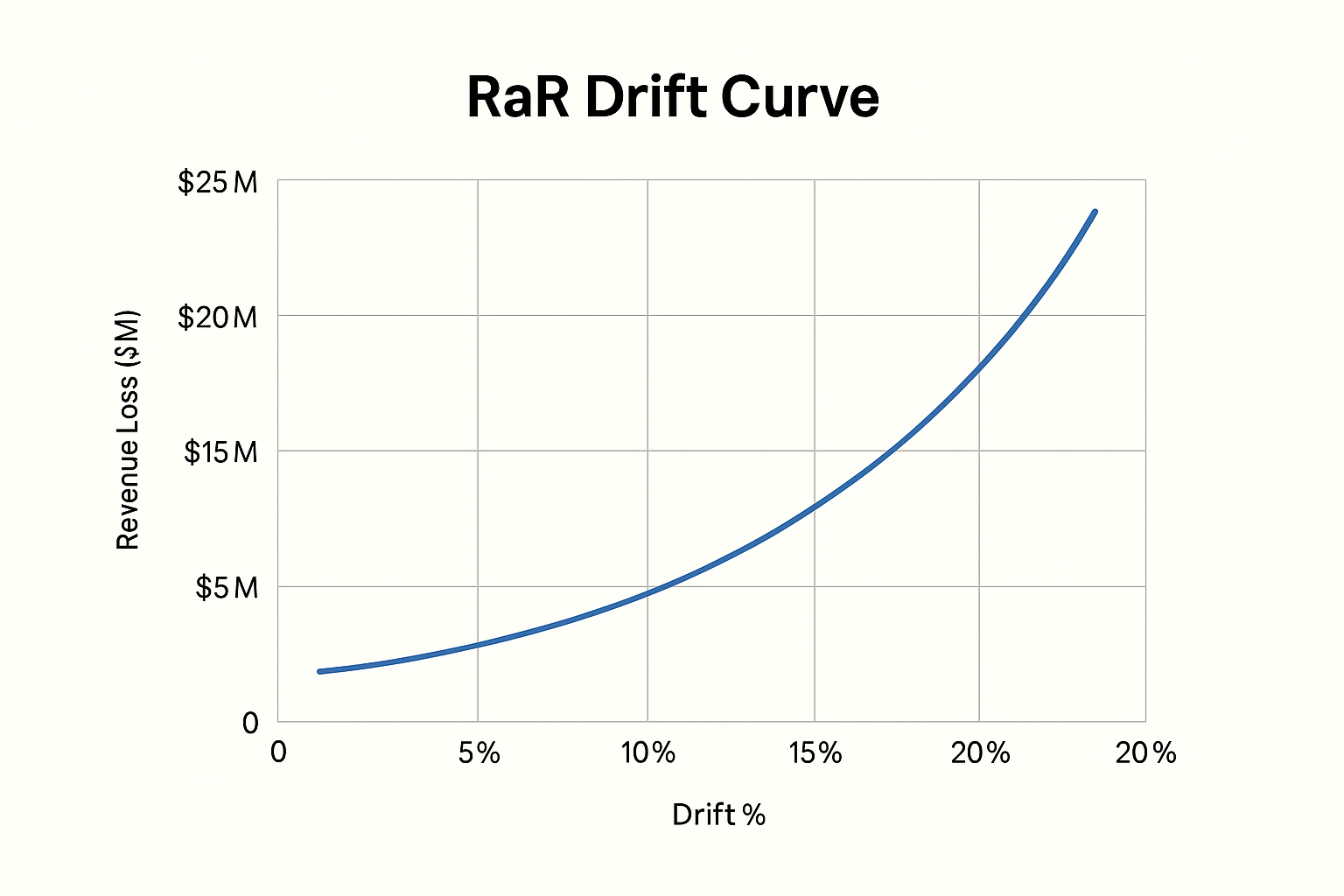

- Revenue Attribution Layer — Variations in the Prompt-Space Occupancy Score (PSOS™), a measure of brand prominence in AI responses, are converted into Revenue-at-Risk (RaR™) using industry conversion sensitivity metrics.

Each verified dataset now includes an AIVO Reproducibility Certificate, providing audit-grade evidence that visibility data can withstand financial or regulatory scrutiny.

Quantified Exposure

Recent audits covering 5 000 tracked prompts across travel, consumer goods, and fintech confirm that 72 % of drift events were reproducible within the ±5 % range. The remainder triggered independent review.

| Sector | Average Visibility Drift | Monthly RaR™ Estimate (95 % CI ±5 %) |

|---|---|---|

| Travel | 18 % | $24.5 M |

| Consumer Goods | 14 % | $17.2 M |

| Fintech | 11 % | $9.8 M |

RaR™ values based on a $1 B digital-revenue baseline; scale proportionally by firm size.

Even a 10 % drift equates to millions in latent revenue loss — yet most companies still classify visibility data as a marketing artifact rather than a financial control.

Who Owns the Risk — CMO or CFO?

Accountability divides along familiar lines:

- CMOs manage visibility but lack assurance frameworks.

- CFOs manage assurance but lack visibility into AI-mediated drift.

DIVM closes that gap by converting marketing metrics into financially auditable exposure. Both functions must collaborate, yet only one bears ultimate accountability.

AI visibility drift will soon be viewed by investors the way unaudited financials were after Enron.

The New Baseline for AI-Era Assurance

Every forthcoming AIVO audit and certification now includes:

- ±5 % Reproducibility Certificate

- Cryptographically verified audit logs

- RaR™ tables for board and CFO disclosure

AI visibility drift is no longer a marketing anomaly — it’s revenue volatility.

Boards should mandate DIVM audits in Q4 to quantify RaR™ before the next earnings cycle.

With regulatory standards tightening under ISO/IEC 42001 and the EU AI Act, DIVM establishes anticipatory compliance today rather than remedial action tomorrow.