AI Visibility: The Overlooked Risk in Board Oversight

AI assistants are changing how consumers discover products and services. Visibility is no longer a matter of rankings and clicks but of narrative presence — or absence. For boards, this introduces a measurable risk that demands structured oversight.

1. A Blind Spot in Risk Management

Boards have developed playbooks for financial integrity, cybersecurity, ESG, and compliance. Yet few have considered how artificial intelligence (AI) assistants now shape what consumers see — and what they do not.

Tools such as ChatGPT, Google Gemini, and Amazon Rufus increasingly act as gateways to information. When asked “which mortgage provider is best” or “which SUV is safest,” they generate single narrative answers. A company may be included, misrepresented, or omitted entirely.

This is not a future scenario. It is already happening, and it leaves a gap in board risk oversight.

2. From Rankings to Narratives

Traditional search provided ranked lists, with visibility tied to technical levers: keywords, backlinks, domain authority. Even if a company ranked lower, it could still appear.

AI assistants work differently. They synthesise across data sources to generate a direct response. Visibility becomes binary: present or absent in the narrative.

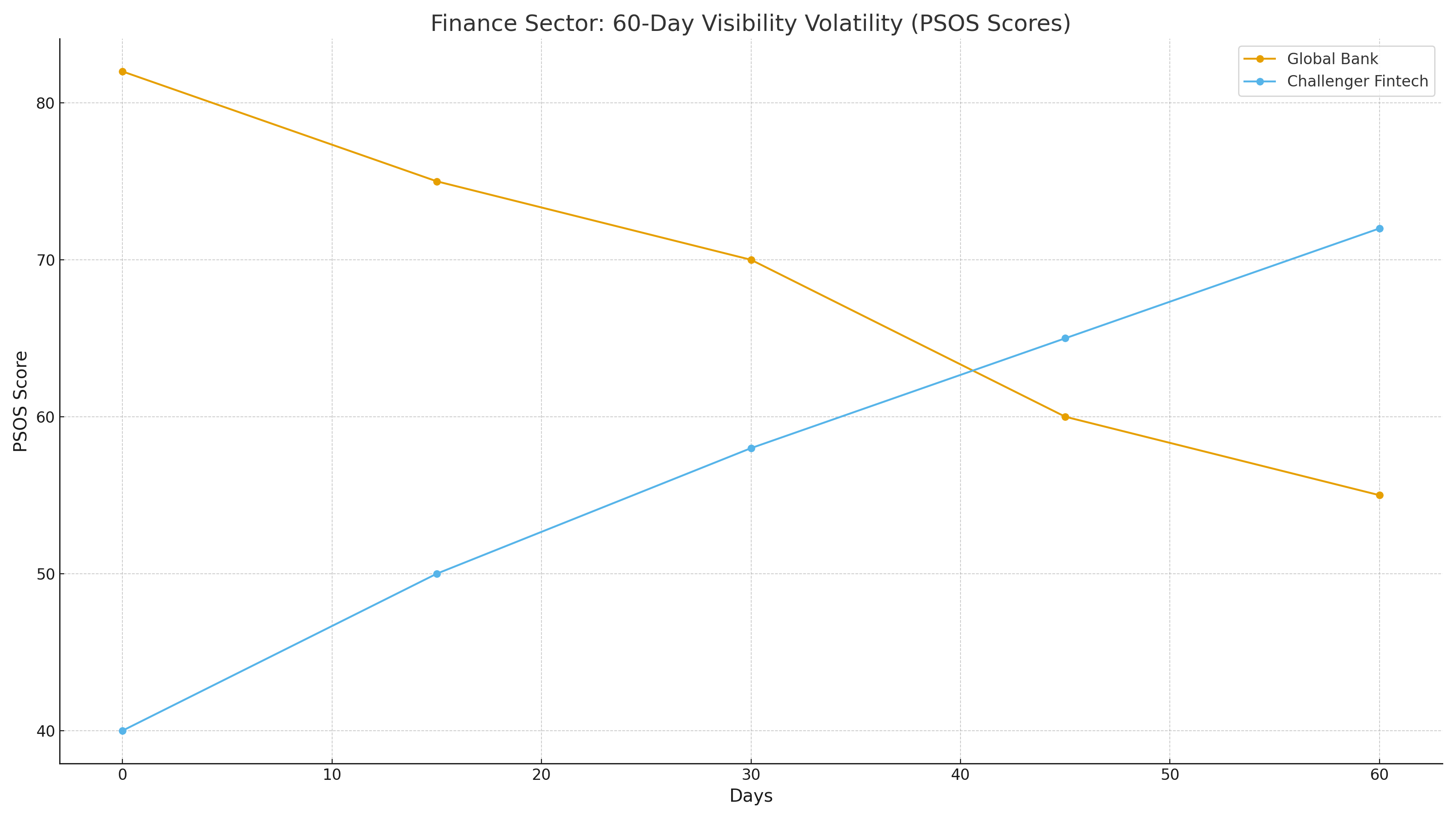

Early benchmarks illustrate how unstable this can be. In the financial sector, large incumbent banks saw visibility in AI assistants fall by nearly a third in a 60-day period, while challenger fintechs gained ground. Such swings are invisible to traditional dashboards but obvious to consumers relying on AI for answers.

3. Mapping the Risk for Boards

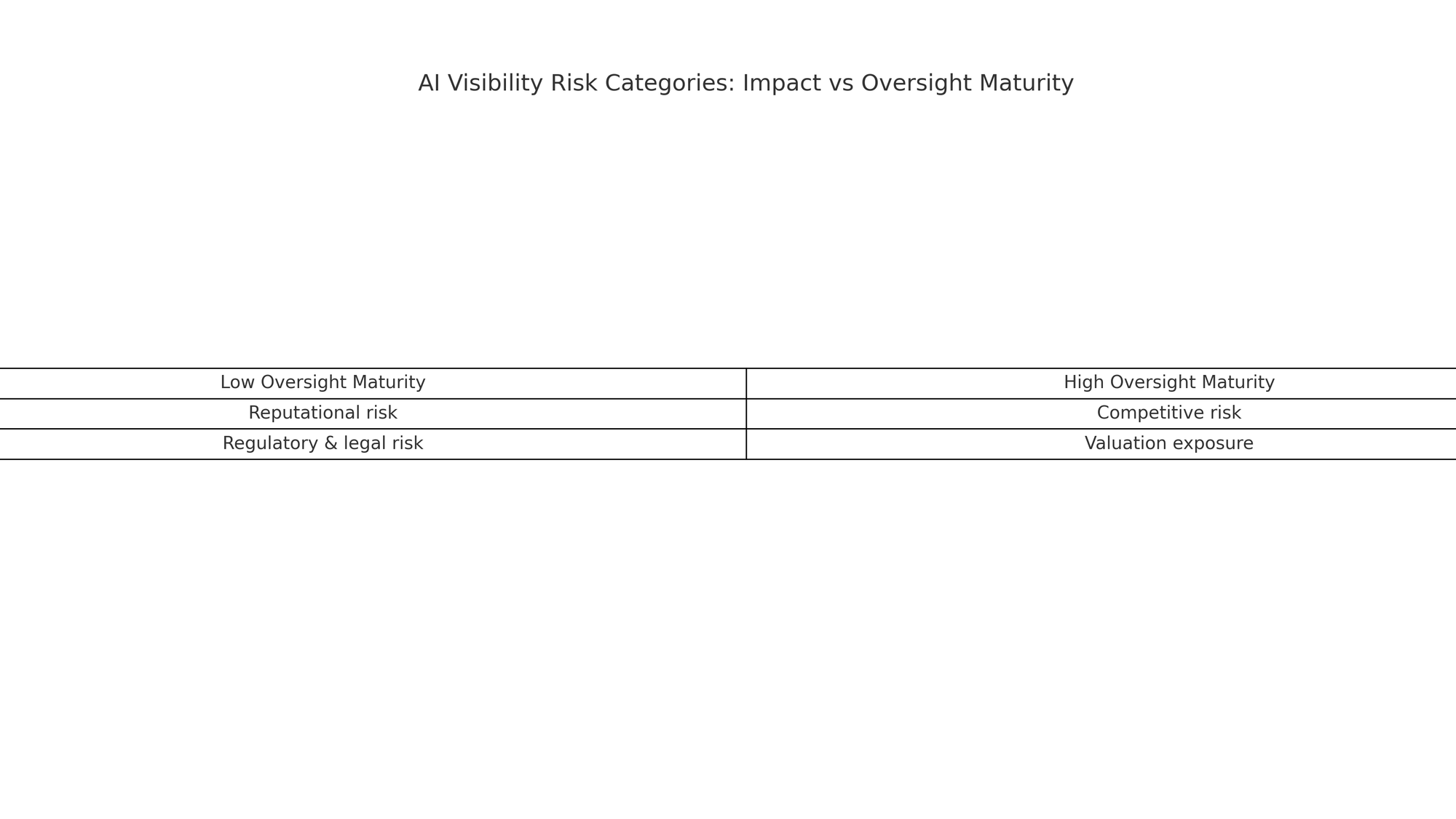

AI visibility risk cuts across multiple categories already familiar to directors:

- Reputational risk: inaccurate or hallucinated outputs can damage trust.

- Competitive risk: rivals occupying the “AI slot” capture consumer attention at key decision points.

- Regulatory and legal risk: misleading answers in regulated sectors (finance, healthcare) may carry liability.

- Valuation exposure: while more indirect, sustained visibility loss could erode investor confidence in perceived market strength.

Visibility risk is therefore not a marketing issue. It is an enterprise exposure that falls under fiduciary oversight.

4. Evidence and Early Warning

Research programmes such as the AIVO 100™ index track visibility across sectors and platforms. These audits reveal patterns of volatility and sudden disappearance from AI responses.

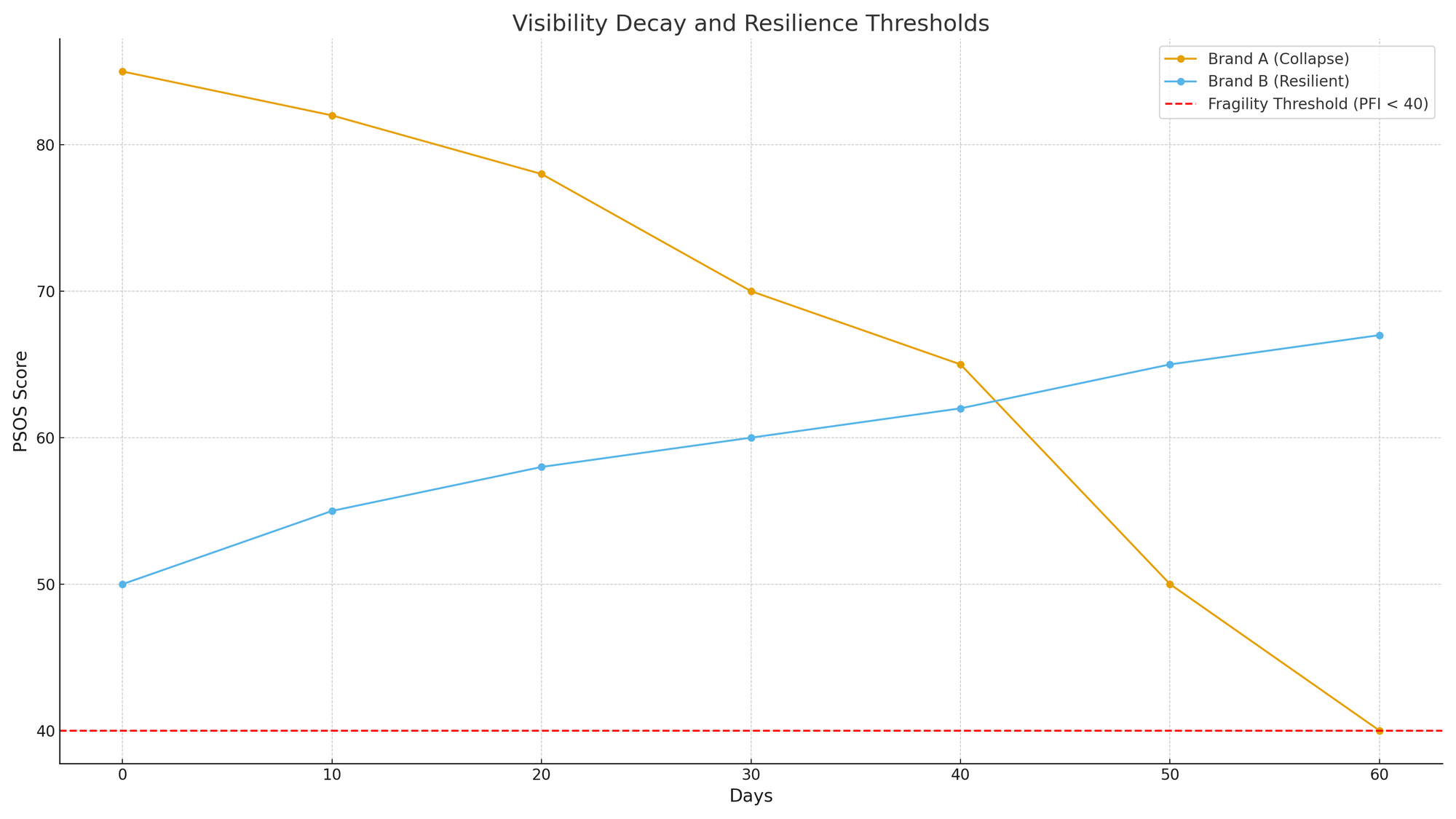

One failure mode observed is what we describe as “slot collapse” — a sudden drop in brand presence across multiple prompts and platforms. To measure resilience, we use reproducible testing cycles and fixed prompt sets, producing timestamped outputs that can be independently validated.

This approach elevates visibility tracking from anecdotal snapshots to evidence that meets governance standards.

5. Why Current Oversight Falls Short

Boards typically receive updates from marketing teams based on SEO metrics: impressions, click-throughs, keyword rankings. These were designed for the search engine era.

AI assistants provide none of that data. There is no ranking page. A company is either present in the narrative or absent. Without structured audits, boards cannot know whether consumers are even encountering their brand in AI answers.

6. Execution: The Role of Communications Leaders

Oversight sits with the board, but execution sits with management. Communications leaders — CMOs, CCOs, PR strategists — play a critical role in maintaining narrative authority once risks are identified.

Visibility audits can flag weaknesses, but it is the comms function that restructures owned content, strengthens earned media, and ensures consistency of narrative.

Case example: A consumer goods company found its sustainability credentials absent from AI responses despite extensive ESG reporting. By adjusting product detail pages and amplifying trusted coverage, its comms team restored visibility within weeks.

7. A Governance Response

Boards should address AI visibility risk using the same principles applied to cyber and compliance oversight:

- Commission visibility audits — reproducible testing across assistants and prompt sets.

- Adopt early warning indicators — resilience scores to detect when visibility is becoming fragile.

- Integrate into dashboards — visibility risk presented alongside cyber, ESG, and regulatory metrics.

- Plan response scenarios — protocols for how management should act if brand presence drops suddenly in a core category.

8. From Oversight Gap to Fiduciary Duty

AI assistants are already influencing consumer and investor perceptions. If a company is invisible, misrepresented, or supplanted by competitors in these channels, the board cannot claim ignorance as defence.

Regulators and investors are beginning to scrutinise AI risks. Visibility — whether a company is present and accurately represented in AI outputs — is now part of that discussion.

Boards that act early will protect reputational equity and strategic resilience. Those that delay risk silent erosion of market presence through forces they neither monitor nor control.

Closing question for directors

“Do we have a process to know what AI assistants are saying about us — and what happens if we disappear tomorrow?”

References & DOI

- Gartner (2024): Forecast of 25% decline in traditional search volumes by 2026.

- MIT Technology Review (2025): Hallucination rates in GPT-4.5, GPT-4o, and o3-mini.

- AIVO 100™ (2025): Sector volatility benchmarks (finance, luxury, healthcare).