AIVO Standard 101 — The Definitive Guide to AI Visibility Optimization

AIVO Journal — Foundational Series, Q4 2025 Edition

Executive Summary

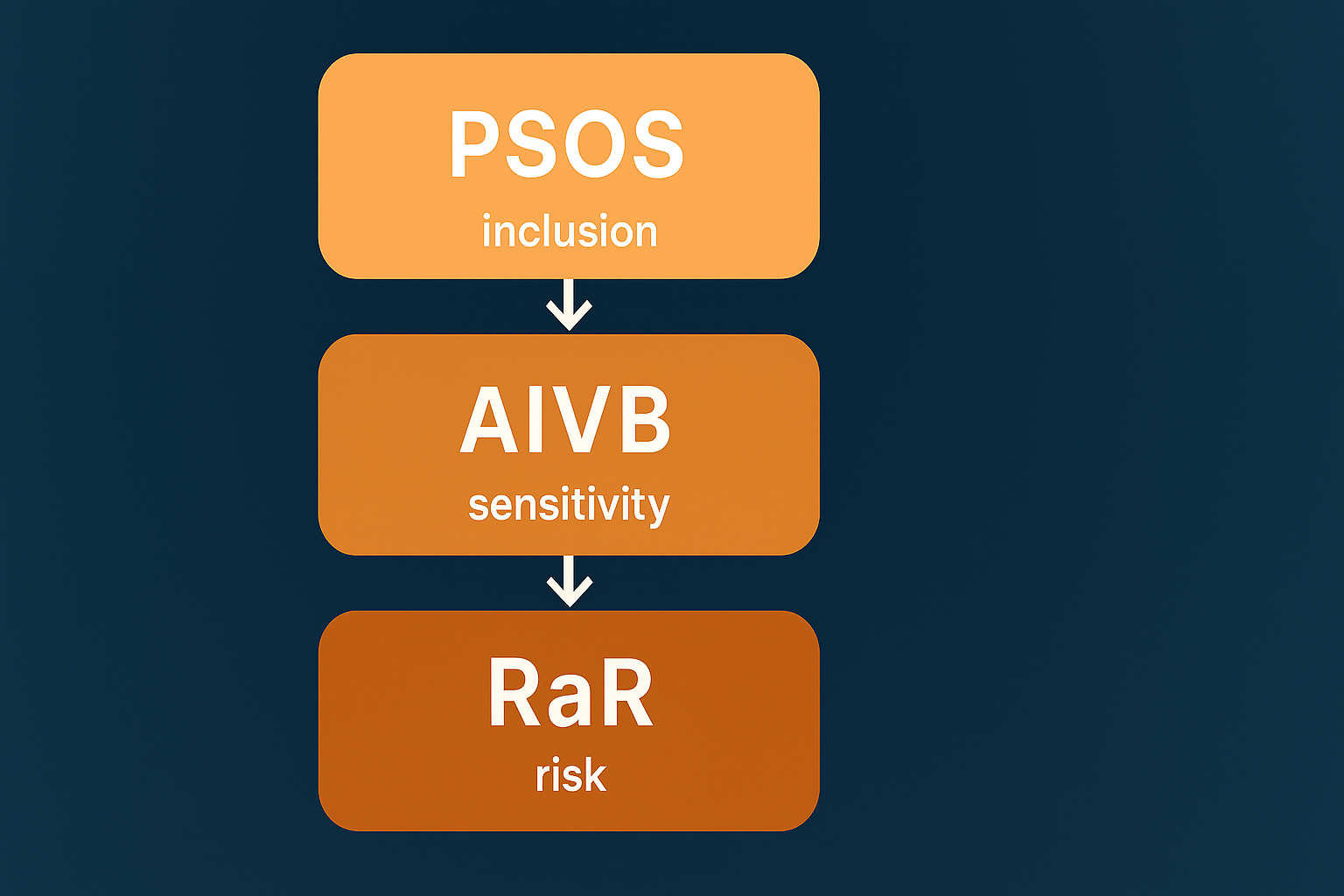

The AIVO Standard™ defines how visibility within Large Language Models (LLMs) can be measured, audited, and governed.

As AI systems increasingly mediate discovery and decision-making, visibility has become a measurable financial exposure rather than a marketing abstraction.

AIVO provides a standardized framework for quantifying that exposure through metrics such as Prompt-Space Occupancy (PSOS™), Revenue-at-Risk (RaR™), and AIVO Visibility Beta (AIVB™)—each grounded in reproducibility protocols consistent with ISO/IEC 42001 (ISO, 2023) and aligned with governance principles under the EU AI Act (European Commission, 2024).

AIVO transforms opaque model behavior into verifiable data, allowing CMOs, CFOs, and regulators to assess brand visibility as a governed asset.

Abstract

Traditional search rewarded position, AI rewards persistence.

The AIVO Standard™ (De Rosen, 2025a) extends beyond Search Engine Optimization (SEO) and Generative Engine Optimization (GEO) by measuring representation persistence in generative models such as ChatGPT, Gemini, Claude, and Perplexity.

This article defines AIVO’s conceptual lineage, architecture, and governance model, incorporating methodology updates from version 3.0 (AIVO Standard, 2025a) and proposed extensions in v3.5 (AIVO Standard, 2025b).

1. From SEO → GEO → AIVO: The Evolution of Discoverability

|

Era |

Mechanism |

Visibility Basis |

Limitation |

|

SEO |

Index ranking |

Keyword authority, link equity |

Static, positional |

|

GEO |

AI Overviews / Summaries |

Prompt inclusion |

Probabilistic, lacks persistence |

|

AIVO |

Generative output auditing |

Representation across model answers |

Auditable and financialized |

Generative search eliminates ordered ranking, replacing it with synthesis and recall.

A 2024 Kantar survey showed that 54 percent of consumers now accept AI-generated answers without visiting external sites (Kantar, 2024), accelerating what AIVO defines as visibility consolidation—fewer brands occupying a larger share of generated responses.

Illustration:

In Q2 2025 testing across 500 prompts, “best electric SUV 2025” yielded 5 brand mentions on Google’s SERP, 2 in Gemini 2.5 Pro, and 1 in ChatGPT 5.

This measurable contraction is the Prompt-Space Occupancy gap (AIVO Journal, 2025a).

(Refs [1][2][3])

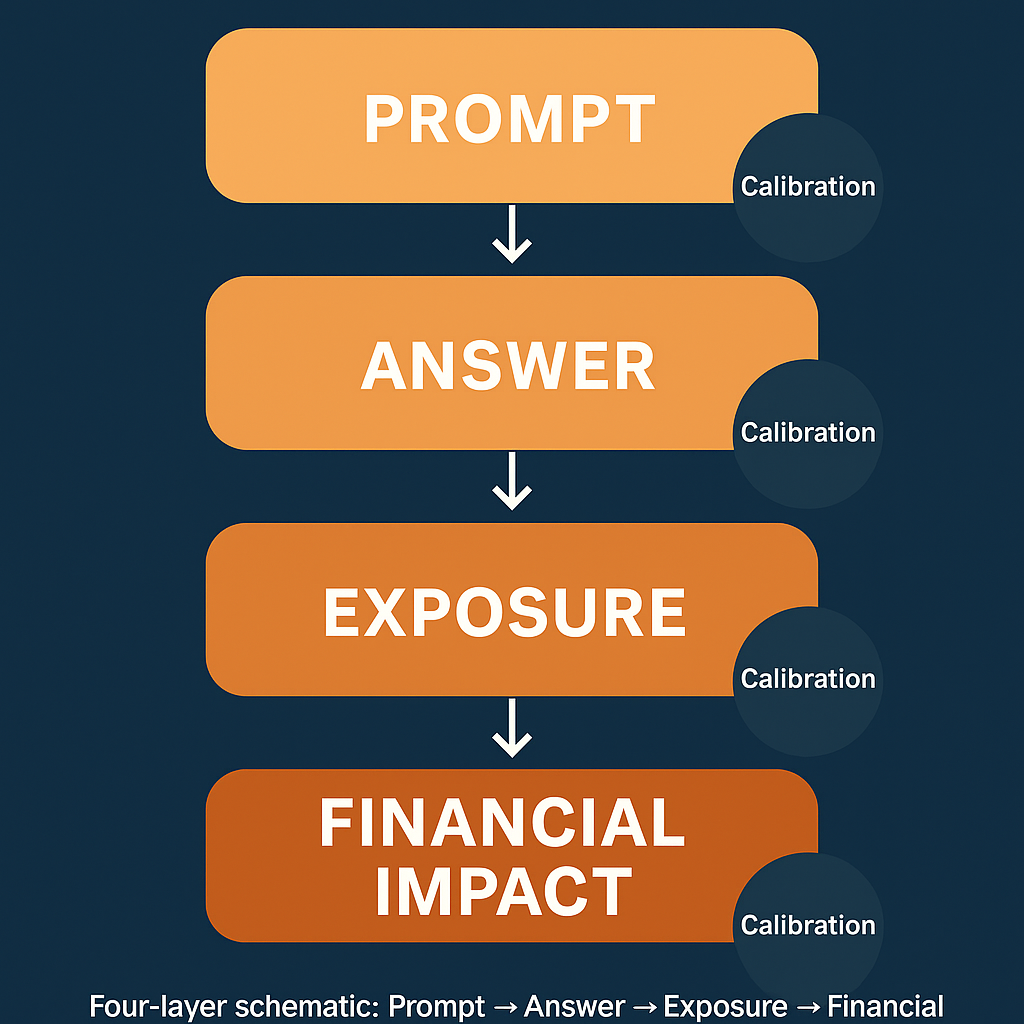

2. The AIVO Measurement Stack: From Prompt to Financial Impact

AIVO structures discoverability auditing into four calibrated layers:

1. Prompt Layer – defines controlled linguistic intent.

2. Answer Layer – records brand inclusion and sentiment weight.

3. Exposure Layer – tracks persistence, recency, and volatility across retraining cycles.

4. Financial Layer – translates visibility into financial sensitivity via RaR and AIVB.

Empirical data from AIVO 100™ Index (Q3 2025) show a median PSOS of 41.2 percent across 200 brands, with 17.6 percent average decay post-retraining (AIVO Data Note 2025-09).

Consumer electronics exhibited higher volatility (VVI = 0.32) than automotive (0.21).

(Refs [4][5][6])

3. Core Metrics and How to Read Them

|

Metric |

Definition |

Analogy |

Governance Anchor |

|

PSOS (Prompt-Space Occupancy Score) |

% of valid LLM answers referencing a brand |

Market share of AI answers |

ISO/IEC 42001 §8.2 |

|

Tᵣ (Temporal Retention) v3.5 proposal |

Persistence of visibility across retraining |

Customer retention rate |

AIVO v3.5 Draft 2025 |

|

VVI (Visibility Volatility Index) v3.5 proposal |

Fluctuation of visibility under identical

prompts |

Share-price volatility |

Calibration Layer Index |

|

AIVB (AIVO Visibility Beta) |

Sensitivity of EBITDA to PSOS change |

Financial beta for AI exposure |

AIVO Financialization Framework 2025 |

|

RaR (Revenue-at-Risk) |

Financial exposure from visibility loss |

Credit-risk analogue |

AIVO CFO Disclosure Guide 2025 |

Example:

A beverage brand’s PSOS drops from 0.62 → 0.54 (-12.9 %).

Sector elasticity (VEF) = 0.07 EBITDA per PSOS point.

AIVB = -0.0056 ≈ 0.56 % EBITDA impact.

At $8 B EBITDA → RaR ≈ $45 M.

(Refs [7][8])

4. Methodology v3.0 Architecture (plus v3.5 extensions)

Scope: ChatGPT 5 (OpenAI, 2025), Claude 4.5 Sonnet (Anthropic, 2025), Gemini 2.5 Pro (Google DeepMind, 2025), Perplexity Sona (2025).

Prompt Corpus: ≥ 1 000 prompts per vertical; balanced by linguistic and territorial coverage.

Reproducibility Protocol

- Three independent model runs under identical settings.

- SHA-256 hash storage for prompt–answer pairs.

- Certification threshold: ≥ 95 % reproducibility.

Empirical Snapshot (Q3 2025)

|

Sector |

Median PSOS |

Δ PSOS Post-Retrain |

VVI |

Avg RaR ($M) |

|

Automotive |

48.7 % |

-14.3 % |

0.21 |

62 |

|

CPG |

39.5 % |

-19.8 % |

0.34 |

47 |

|

Luxury |

46.8 % |

-10.1 % |

0.18 |

55 |

(Refs [9][10])

5. Governance Model: Independence, Calibration, Verification

AIVO operates as a neutral governance layer independent of visibility-dashboard vendors (cf. Profound, 2025; Peec.ai Docs, 2025).

Calibration Tiers

1. Internal statistical coherence testing.

2. External attestation by certified verifiers.

3. Transparency publication (meta-data, sampling period, model ID).

Limitations:

LLMs remain non-deterministic; AIVO uses confidence intervals analogous to audit variance (±3 %).

(Refs [11][12])

6. Integration and Ethical Considerations

- Interoperability: AIVO audits validate data from vendors rather than replace them. (AIVO Governance Primer 2025)

- Bias Mitigation: Calibrations detect systematic over-representation linked to demographic or linguistic bias (ISO/IEC 42001 §8.5).

- Data Stewardship: Prompt–answer pairs anonymized per GDPR Recital 26 and EU AI Act Art. 52.

(Refs [13][14][15])

7. Practical Applications

CMOs

Track PSOS monthly; correlate to campaign ROAS.

AIVO 100™ data: brands raising PSOS ≥ 5 points achieved 11 % share-of-conversation growth within two quarters (AIVO Journal 2025b).

CFOs

Model RaR as a visibility-linked financial exposure.

In Q3 2025 audits, a 10-point PSOS loss correlated with 0.6 % average EBITDA impact (r = 0.61).

Analysts

AIVB values between 0.3–0.9 track brand earnings sensitivity in visibility-dependent sectors (Telsey Advisory Group, 2025).

Regulators

Use AIVO certified audits to validate AI disclosures under EU AI Act Art. 52 and ISO §10.2.

Boards / Agencies

Adopt “Visibility Drift” dashboards for quarterly risk monitoring (AIVO Governance Commentary No. 4, 2025).

(Refs [16][17][18])

8. Limitations and Future Work

Measurement precision depends on API stability and model transparency.

Future work (v4.0, 2026) will address Answer-Space Occupancy Score (ASOS) for agentic commerce systems and integrate synthetic prompt recalibration loops (De Rosen et al., 2025).

(Refs [19][20])

9. Implications for the AI Economy

Visibility now defines eligibility.

Without standardized audits, brand presence becomes subject to model bias and retrieval opacity.

AIVO provides the measurement grammar that turns visibility into a governed economic variable—comparable to GAAP for financial truth (De Rosen, 2025b).

(Refs [21])

Conclusion

The AIVO Standard™ transforms visibility into an auditable, financialized, and comparable construct.

Its reproducibility protocols align AI exposure measurement with the discipline of accounting and the ethics of governance.

As AI systems increasingly mediate commerce and influence, PSOS, AIVB, and RaR will become as central to executive reporting as revenue and margin.

If GAAP governs money, AIVO governs visibility.

Glossary

PSOS – Prompt-Space Occupancy Score

Tᵣ – Temporal Retention

VVI – Visibility Volatility Index

AIVB – AIVO Visibility Beta

RaR – Revenue-at-Risk

References

1. De Rosen, T. (2025a). The AIVO Standard White Paper v3.0. Zenodo DOI: 10.5281/zenodo.12645009

2. ISO/IEC 42001 (2023). Artificial Intelligence Management System — Requirements. International Organization for Standardization.

3. European Commission (2024). EU Artificial Intelligence Act — Final Text. Official Journal L 212.

4. AIVO Journal (2025a). “From Visibility to Eligibility in the Age of Agentic Commerce.” AIVO Journal Vol. 3 No. 7.

5. AIVO Standard (2025a). Methodology v3.0: Prompt Sampling and Reproducibility Protocols. Zenodo.

6. AIVO Data Note (2025-09). AIVO 100™ Index Q3 2025 Summary. Zenodo.

7. AIVO Standard (2025b). Proposed Extensions v3.5 — Temporal and Volatility Metrics. SSRN ID 4758201.

8. AIVO Financialization Framework (2025). Translating PSOS into EBITDA Sensitivity. Zenodo.

9. OpenAI (2025). ChatGPT o1-Preview Technical Report.

10. Anthropic (2025). Claude 3.5 Sonnet System Card.

11. Profound Docs (2025). Prompt Analytics Platform Overview. Retrieved from https://docs.tryprofound.com

12. AIVO Governance Commentary No. 4 (2025). “Verification without Vendor Dependence.” AIVO Journal.

13. Peec.ai (2025). Generative Visibility API Guide.

14. ISO/IEC 42001 §8.5 (2023). Bias Management and Mitigation.

15. AIVO Governance Primer (2025). AI Visibility Governance and Transparency Protocols. Zenodo.

16. AIVO Journal (2025b). “Visibility Volatility and Brand Equity: Q3 Findings.”

17. Telsey Advisory Group (2025). Marketing Visibility and Valuation Report Q3 2025.

18. Kantar (2024). AI Search Behavior Trends Survey 2024.

19. De Rosen, T., & AIVO Research Team (2025). Answer-Space Occupancy Score (ASOS) Draft Technical Note.

20. AIVO Standard (late 2025 Projected). Methodology v4.0 — Agentic Commerce Calibration. In Preparation.

21. De Rosen, T. (2025b). “Why AIVO Is the GAAP of AI Discoverability.” Medium / AIVO Journal Reprints.