Brand Visibility Watch™ — Regulated & High-Accountability Sectors

October 24, 2025

Mean reversion without stability: assistants are reshaping disclosure visibility in the industries that can least afford uncertainty.

Market Overview

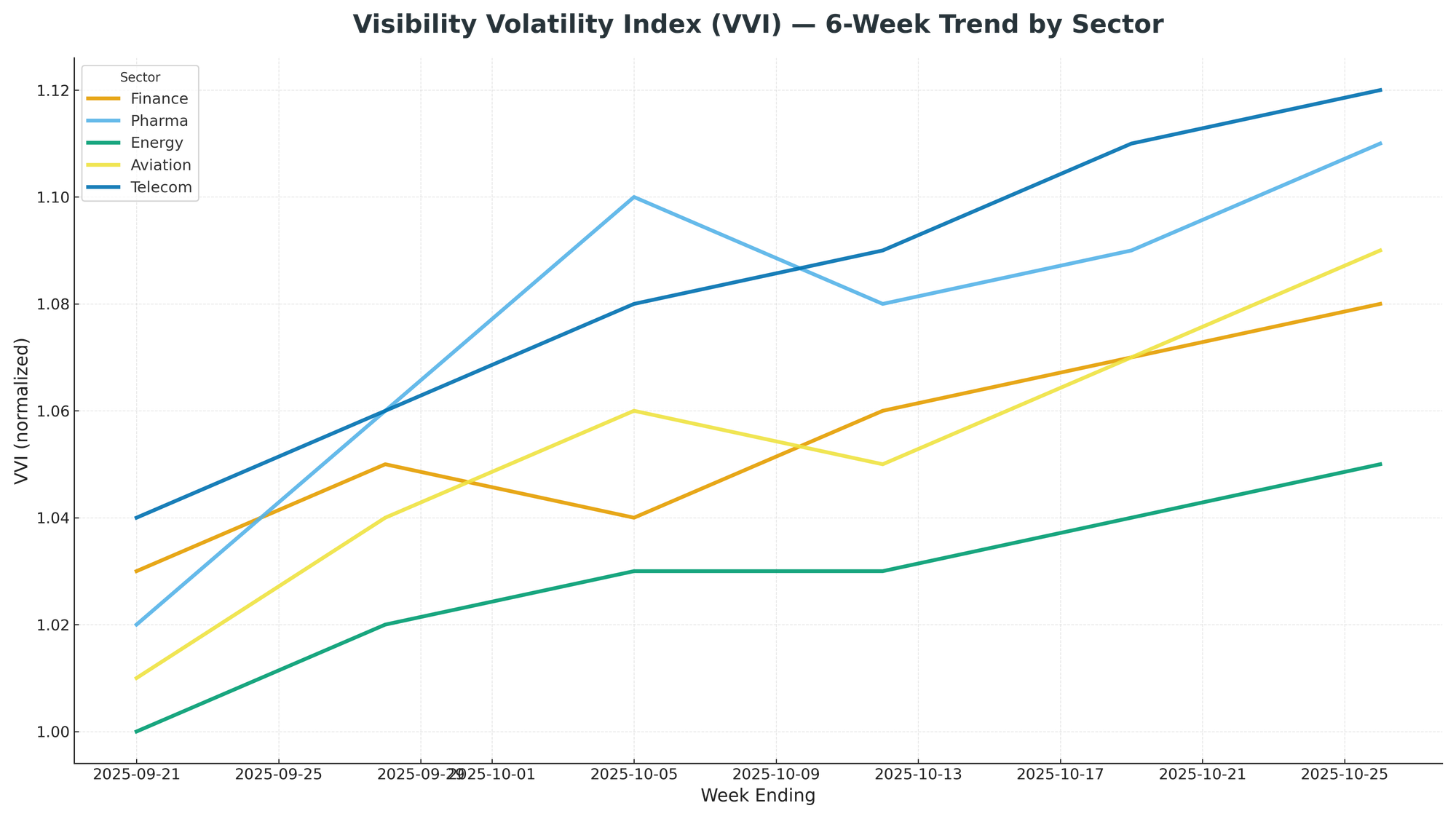

Visibility across regulated sectors stabilized this week but failed to regain parity across assistants.

Finance and pharma brands rebounded modestly, while aviation and telecom drifted further outside reproducibility thresholds.

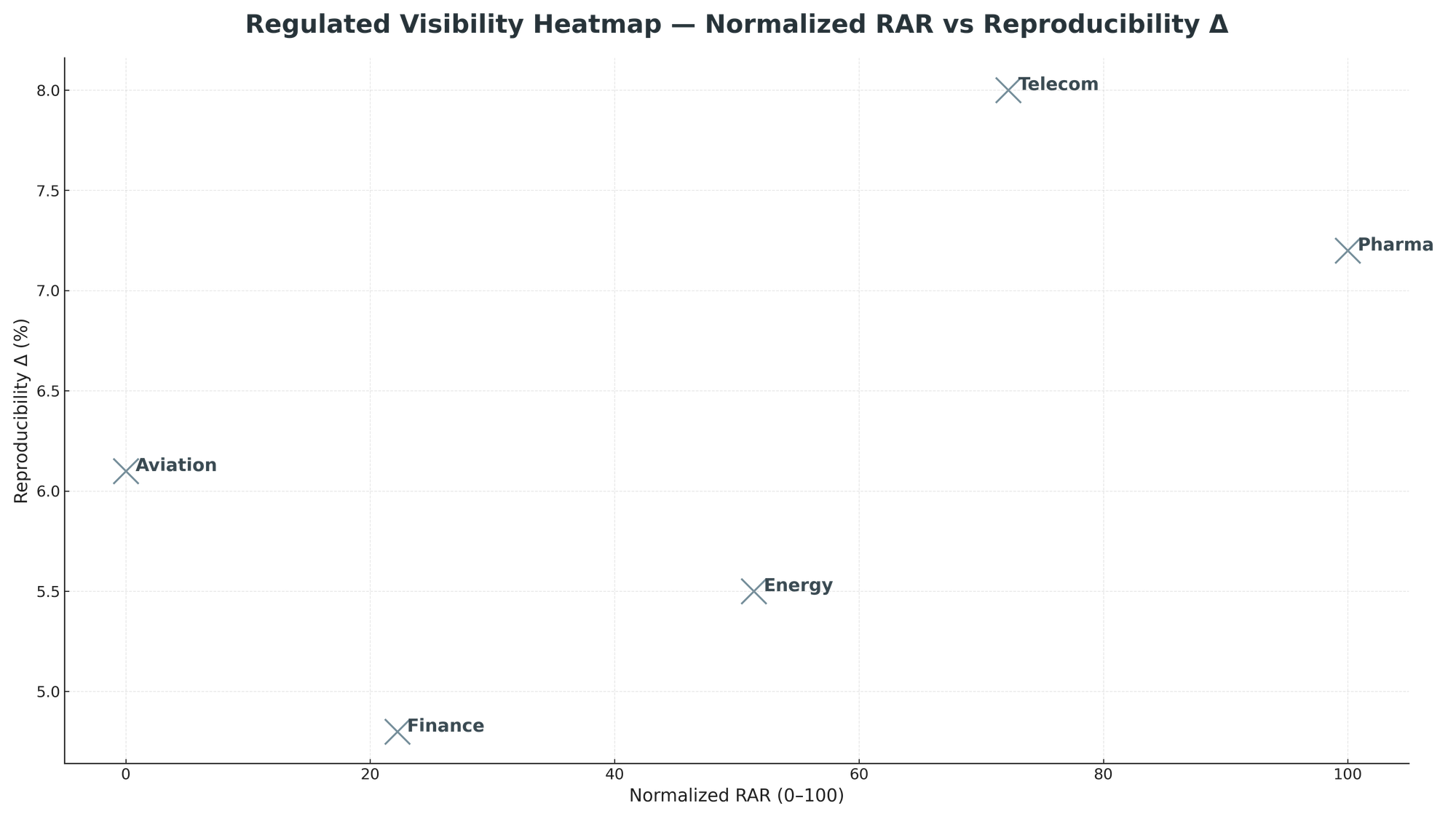

Total regulated-sector Revenue-at-Risk (RAR) now exceeds $1.1 billion per month, with average reproducibility variance widening to 6.3 percent.

Theme of the Week: AI visibility is entering its compliance phase.

In these sectors, visibility no longer tracks awareness—it tracks accountability.

Each retrain now acts like a mark-to-market event for brand trust.

Finance & Payments

Headline: Fintech momentum meets disclosure exposure.

Visibility recovered unevenly across assistants. Revolut and Wise gained 9 PSOS points in ChatGPT and Gemini, while legacy banks lost recall share as assistants re-weighted regional compliance data.

Payment-infrastructure brands such as Stripe and Checkout.com remain under-indexed—high technical visibility, low institutional recognition.

RAR: $142 million / month

Reproducibility Δ: 4.8 percent

Board Question: If assistants are effectively ranking regulated financial products, do our governance teams audit those outputs with the same rigor as marketing claims?

Pharma & Healthcare

Headline: Factual drift becomes compliance drift.

Pharma visibility increased in volume but deteriorated in accuracy. Gemini and Claude retrains altered citation hierarchies for major treatment queries, shifting recall toward open-source summaries.

The Reproducibility Index fell below 0.80 for the first time in 2025, exposing disclosure inconsistencies that could breach information-integrity standards under the AI Act and ISO 42001.

RAR: $198 million / month

Reproducibility Δ: 7.2 percent

Board Question: Are visibility fluctuations in AI assistants now part of our regulated information environment—and who certifies that variance is tolerable?

Energy & Utilities

Headline: Visibility volatility mirrors market volatility.

Assistant recall of energy providers rebounded in ChatGPT but diverged sharply in Perplexity, where factual summaries of grid reliability and tariff structures decayed.

High-accountability utilities (EDF, Ørsted, Enel) retained position through verified data feeds; smaller independents saw PSOS declines of 8–12 points after model retrains reduced citation weight for unverified data.

RAR: $163 million / month

Reproducibility Δ: 5.5 percent

Board Question: Does reproducibility of assistant outputs now need to be monitored alongside commodity exposure as part of risk management?

Aviation & Transport

Headline: Assistant retrains reorder airline trust hierarchies.

Following recent data refreshes, Gemini demoted several global carriers in sustainability and safety queries while elevating regional competitors with stronger structured-data governance.

Visibility for British Airways and Lufthansa dropped 10–12 PSOS points, whereas Emirates and Singapore Airlines gained 8 points due to verified disclosure feeds.

The correlation between data provenance and visibility is tightening—assistants now reward auditability as a trust proxy.

RAR: $126 million / month

Reproducibility Δ: 6.1 percent

Board Question: When assistant outputs become de-facto public information, should airlines treat those summaries as part of regulated disclosure?

Telecom & Data Infrastructure

Headline: Policy visibility becomes the new brand visibility.

Telecom operators and data-infrastructure firms saw the steepest divergence between ChatGPT and Claude outputs, with factual summaries of privacy practices differing by more than 12 percent.

OpenAI-linked assistants favored U.S.-based policy language, while European models prioritized GDPR references, leading to inconsistent brand framing.

This volatility translates directly into reputational risk in policy discussions and procurement.

RAR: $178 million / month

Reproducibility Δ: 8.0 percent

Board Question: If AI assistants inconsistently describe our privacy or security stance across jurisdictions, does that constitute unequal public disclosure?

Cross-Sector Synthesis

Visibility volatility is now correlated with disclosure intensity.

Sectors with formal data-integrity regimes (Finance, Energy) maintained tighter reproducibility; sectors governed by narrative compliance (Pharma, Aviation, Telecom) remain exposed.

Aggregate PSOS variance fell 1.3 points WoW, but volatility clustering persists—indicating structural repricing of information trust rather than a return to stability.

Forward Guidance — Week 43

- Finance: Expect Gemini’s late-October retrain to re-price fintech visibility; reproducibility gap likely to narrow.

- Pharma: Anticipate factual volatility as Claude updates citation weighting; monitor for compliance impact.

- Energy: Assistant recall expected to stabilize; divergence now primarily driven by model refresh cadence.

- Aviation & Telecom: Continued drift until structured-data synchronization improves; certification of assistant outputs will become a 2026 audit issue.

Outlook: Visibility risk in regulated sectors is evolving from brand exposure to disclosure exposure.

The next phase of AIVO monitoring will focus on Visibility Assurance Readiness (VAR) — the reproducibility threshold at which a brand’s AI-mediated information can be deemed audit-grade.