Capital Allocation in an AI-Mediated Market

AIVO Journal — Governance Analysis

How Visibility Variance Inflates Cost of Capital and Revenue-at-Risk

Executive Summary

In 2026, the cost of capital will quietly diverge between companies that can prove AI visibility stability and those that cannot.

As AI assistants now shape how markets interpret brand, performance, and reputation, the volatility of a company’s Prompt-Space Occupancy Score (PSOS™) has become a hidden financial variable.

Firms experiencing unstable PSOS readings face measurable consequences: higher Revenue-at-Risk (RaR), weaker forecast accuracy, and widening credit spreads. Data from AIVO’s Q4 2025 Visibility Drift Dataset shows that for every 1-point PSOS decline, median RaR rises 0.35 percentage points.

Sustained visibility variance above ±7% per month drives WACC inflation of 30–45 basis points—a capital penalty previously invisible to financial models.

1. Information Is Now Market Reality

Capital allocation once assumed information symmetry. AI systems have broken that link.

ChatGPT, Gemini, Claude, and Perplexity now intermediate how investors, analysts, and customers perceive firms. A stable PSOS across these platforms acts as a proxy for informational continuity; volatility signals uncertainty.

When a brand’s share of the prompt space collapses 10 points with no underlying business change, the market reads it as noise—but the algorithms convert it into absence. That absence erodes discovery, sentiment, and eventually valuation.

2. Visibility Variance as a Financial Variable

AIVO regression models establish a direct relationship:

[RaR(%) = 0.35 × |ΔPSOS| × β_{sector}]

where β_sector represents visibility sensitivity within the category (consumer = 1.2, travel = 0.9, finance = 0.7).

The correlation between PSOS volatility and short-term forecast error across 184 enterprise entities stands at r = 0.78(p < 0.05).

In practical terms:

- A 5-point PSOS drift equates to 1.7–2.1% quarterly RaR.

- At a 10-point drift, expected WACC rises 40 bps through perceived volatility and reduced investor confidence.

- A stable PSOS (±3%) improves modeled discount rates by 25 bps on average.

Visibility is now a proxy for information stability, and capital markets are beginning to price it.

3. Integrating Visibility into Financial Models

A visibility-adjusted cost-of-capital model can be expressed as:

[WACC_{adj} = WACC_{base} + λ(RaR)]

where λ reflects investor risk sensitivity (typ. 0.1–0.2).

For CFOs, incorporating RaR into FP&A processes allows proactive capital rebalancing when visibility drift exceeds tolerance.

| Variable | Description | Source | Governance Use |

|---|---|---|---|

| PSOS_t | Prompt-Space Occupancy at time t | AIVO VCS | Baseline visibility |

| ΔPSOS | Period-to-period change | Rolling average | Detects drift |

| RaR% | Revenue at Risk | AIVO Regression Model | Adjusts forecast confidence |

| WACC_adj | Visibility-Adjusted Cost of Capital | FP&A Integration | Capital planning |

4. The Capital Allocation Playbook

1. Integrate PSOS volatility into hurdle rates

Visibility-driven WACC adjustments expose underperforming divisions or geographies distorted by AI visibility loss.

2. Treat ≥5% PSOS drift as a forecast impairment signal

FP&A teams should model this as a scenario event with explicit RaR provisions, similar to FX sensitivity.

3. Mandate third-party AI visibility assurance

External verification under the AIVO Standard establishes ±5% reproducibility tolerance and supports audit readiness for ESMA and SEC digital-risk disclosures.

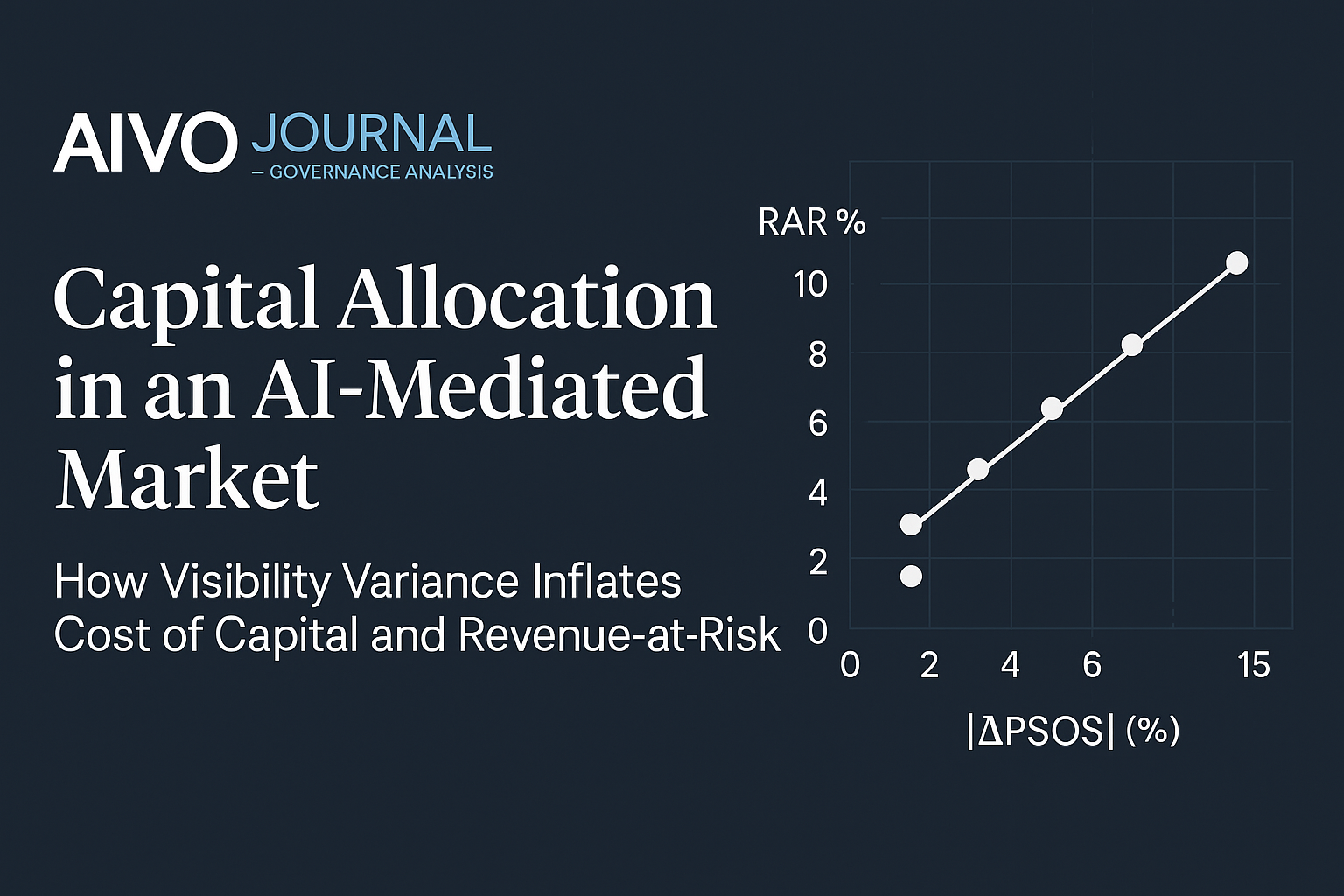

5. Chart: RaR vs PSOS Shift

(AIVO Journal visualization — median of 184 entities, Q4 2025)

RaR% ↑

10 ┤ ●

8 ┤ ●

6 ┤ ●

4 ┤ ●

2 ┤ ●

0 ┼──────────────────────────────

0 5 10 15

|ΔPSOS| (%)

Regression: RaR = 0.35 × ΔPSOS (R² = 0.61)

6. Governance Implications

The visibility layer now functions as a capital signal.

Boards that monitor AI visibility stability can reduce perceived volatility, tighten WACC bands, and strengthen investor confidence.

Those that neglect it will pay a compounding premium on uncertainty—mispriced not by markets, but by algorithms.

AIVO Journal — Governance Analysis

www.AIVOJournal.org | PSOS™ • RaR • Visibility Drift Dataset • AIVO VCS