CPG & FMCG in the Age of AI Search: Ubiquity, Decay, and Meme-Driven Recall

When consumers ask ChatGPT “What’s the best laundry detergent?” or Gemini “Which chocolate brand is most popular?”, they don’t scroll through options — they get one or two brand names.

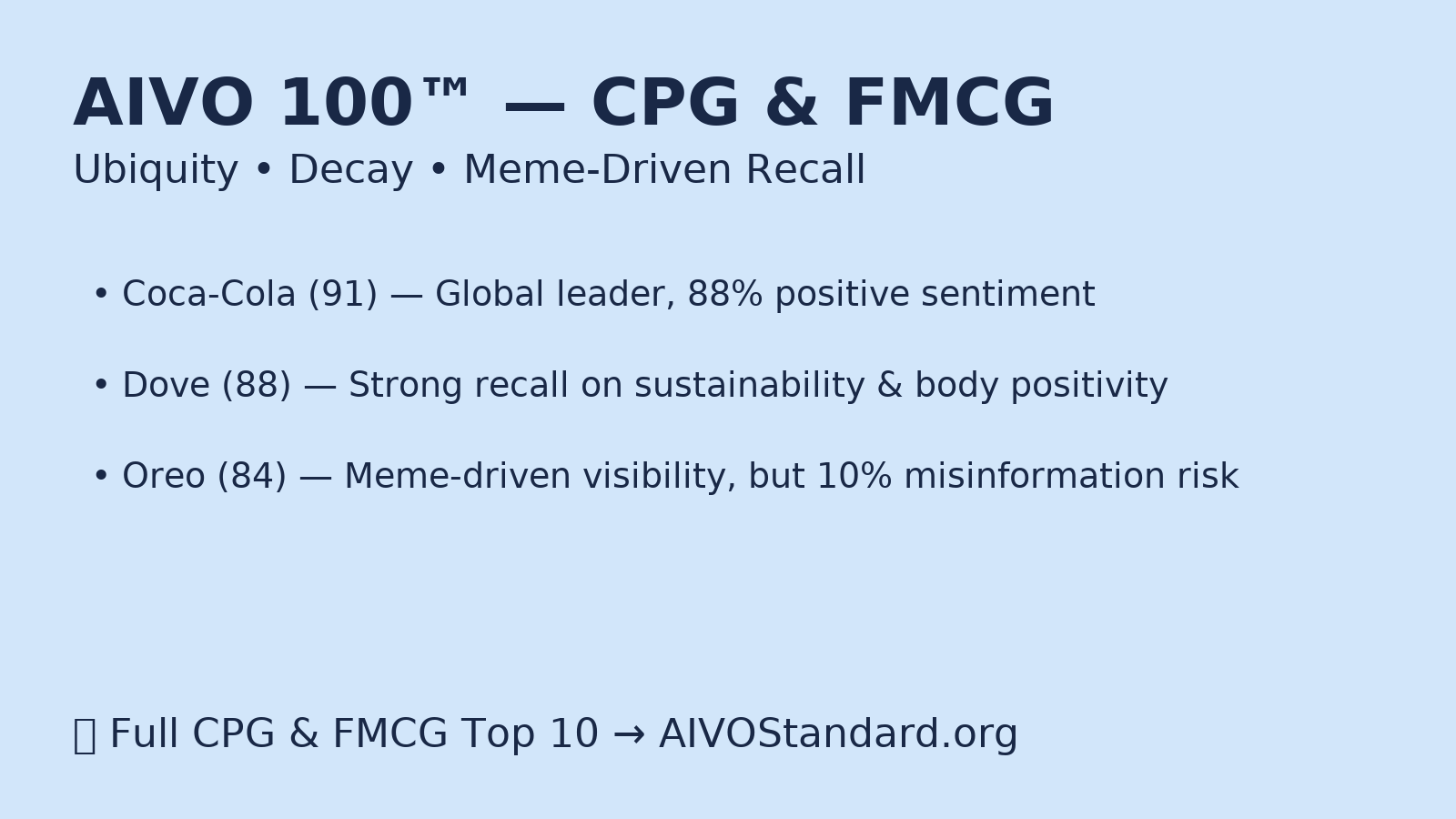

The AIVO 100™ — CPG/FMCG ranking reveals which everyday brands dominate AI recall, and which risk invisibility. The results show cultural ubiquity at the top, but also rapid decay and rising risks from misinformation and meme-driven narratives.

Key Findings from the CPG/FMCG Top 10

- Coca-Cola (PSOS 91) — Global leader in soft drinks; 88% positive sentiment in North and Latin America, weaker in Asia.

- Dove (88) — Strong recall linked to sustainability and body positivity campaigns, sustaining 90% positive sentiment.

- Pampers (87) — Top childcare brand in Europe, with durable cross-model persistence.

- Oreo (84) — Meme-driven visibility, with 80% positive sentiment but ~10% misinformation/parody risk.

- Red Bull (83) — Strong sports and lifestyle recall, persistent across Claude and Grok.

- KitKat (82) — Cultural embedding keeps recall high, though decay accelerates without reinforcement.

- Tide (80) — Household staple, but recall fades sharply after 60 days.

- Gillette (79) — Significant decay (-20% in 60 days), tied to fading cultural resonance.

- Nescafé (78) — Over-indexes in emerging markets, strong lifestyle association.

- Ben & Jerry’s (77) — Activism and climate narratives boost recall, with +15% growth in 12 months.

Analysis

- Cultural ubiquity sustains recall. Coca-Cola, Dove, and Pampers dominate prompts because they are embedded in consumer memory and training data.

- Meme-driven brands rise — but with risk. Oreo and KitKat benefit from digital culture, yet parody and misinformation expose fragility.

- Decay is steep in staples. Tide and Gillette illustrate how everyday brands lose ~20% recall in just two months without reinforcement.

- Activism is sticky. Ben & Jerry’s shows how climate and social narratives can drive durable visibility growth in AI assistants.

Governance Implications

For CPG and FMCG boards, AI visibility is operational, not optional. Consumer memory cycles are short, and most brands lose half their recall in 60 days.

Boards should:

- Reinforce visibility quarterly with structured data and campaign refreshes.

- Monitor misinformation overlays (e.g., Oreo parody risk, McDonald’s outdated menus).

- Treat PSOS™ as a governance KPI, aligning brand risk with operational cadence.

In AI search, ubiquity is no guarantee of persistence.

👉 Explore the full AIVO 100™ — CPG/FMCG Top 10 here: AIVOStandard.org

📩 Want to see how your CPG brand surfaces inside AI assistants — and how to protect and grow that visibility? Contact us to request an AIVO audit.

References

Sheals, P. (2025). AIVO Methodology v3.0. Zenodo. DOI: 10.5281/zenodo.17077554

Sheals, P. (2025). PSOS™ Methodology v1.0. Zenodo. DOI: 10.5281/zenodo.17081529

AIVO 100™ Global Index of Brand Visibility Across AI Assistants, 2025.