Ramp and the PSOS Challenge

Introduction

Corporate spend management has become one of fintech’s fastest-growing battlegrounds. Ramp, competing with Brex, Airbase, and legacy issuers like AmEx, markets itself on automation and cost savings. But as CFOs and founders increasingly consult generative AI systems for recommendations, visibility inside assistants is becoming a determinant of market share.

Findings

Ramp’s performance under the AIVO Standard™ provides a clear snapshot of challenger strength and fragility:

- PSOS 58 — Ramp appears in just over half of relevant prompts, placing behind Brex (62) but ahead of Airbase (54).

- +18% YoY growth — strong trajectory in queries linked to automation, SaaS savings, and CFO toolkits.

- 82% positive sentiment — assistants highlight Ramp’s savings claims and user-friendly UX.

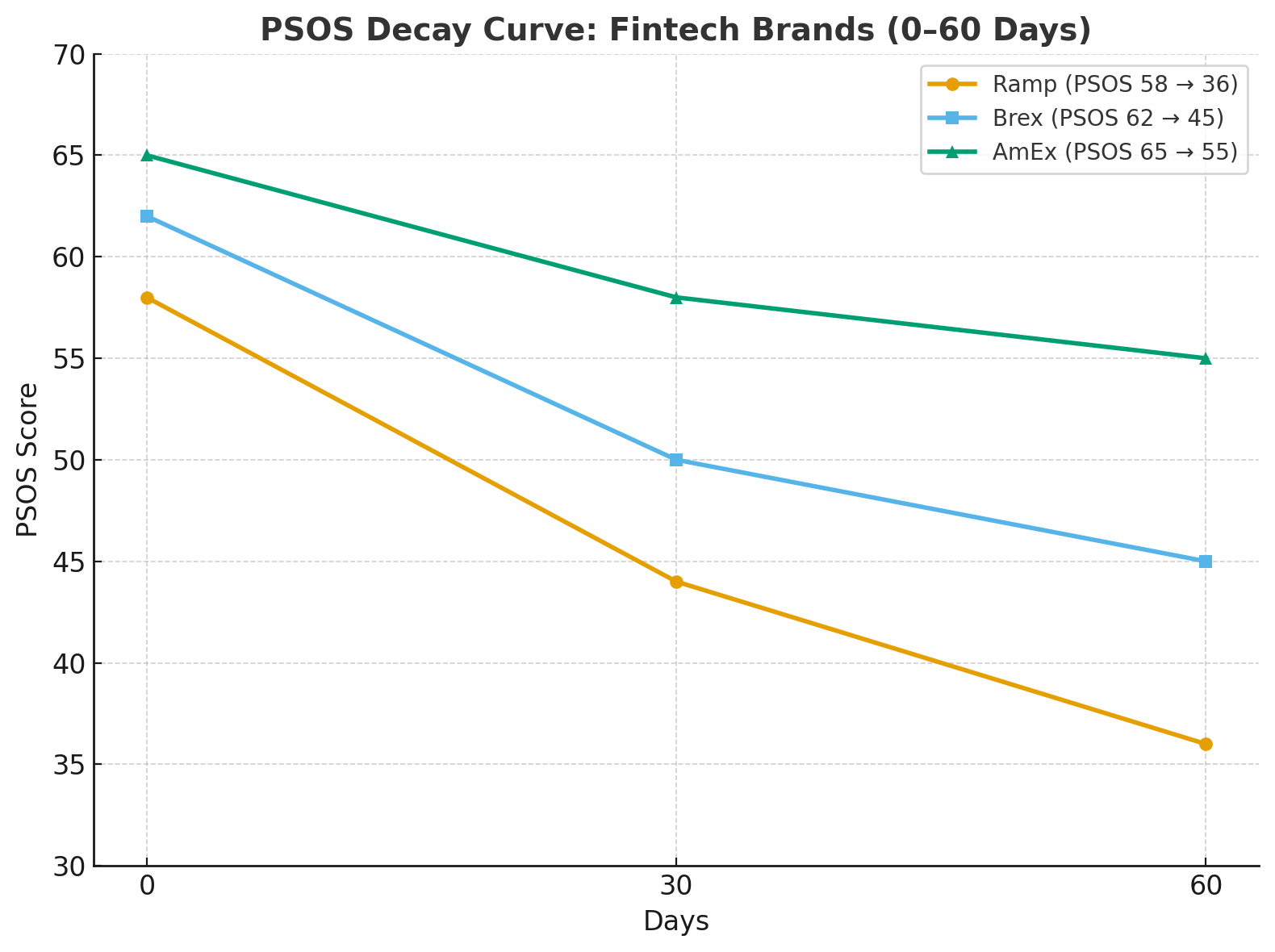

- 38% recall decay in 60 days — compared to Brex (28%) and AmEx (15%). Legacy brands anchor more persistently due to entrenched financial knowledge graphs.

Implications

The data reveals a fintech paradox:

- Challenger momentum — Ramp outpaces incumbents in growth because its automation narrative aligns with AI-driven decision-making.

- Fragile persistence — without reinforcement, Ramp’s recall fades, leaving incumbents to dominate sustained presence.

- Governance necessity — PSOS highlights the need for structured reinforcement (llms.txt, Schema.org finance markup, persistent customer case studies) to stabilize visibility.

Closing

Ramp’s PSOS profile signals a fintech on the rise but vulnerable to invisibility in AI assistants. For CFO-facing brands, the lesson is clear: automation and savings claims drive entry, but persistence requires governance. Without structured reinforcement, challengers risk remaining visible only in the short term.

Source: AIVO Standard™ v3.0, September 2025